Cleartax • 2019 • Design lead

A mobile-first digital ledger for small and medium businesses in India

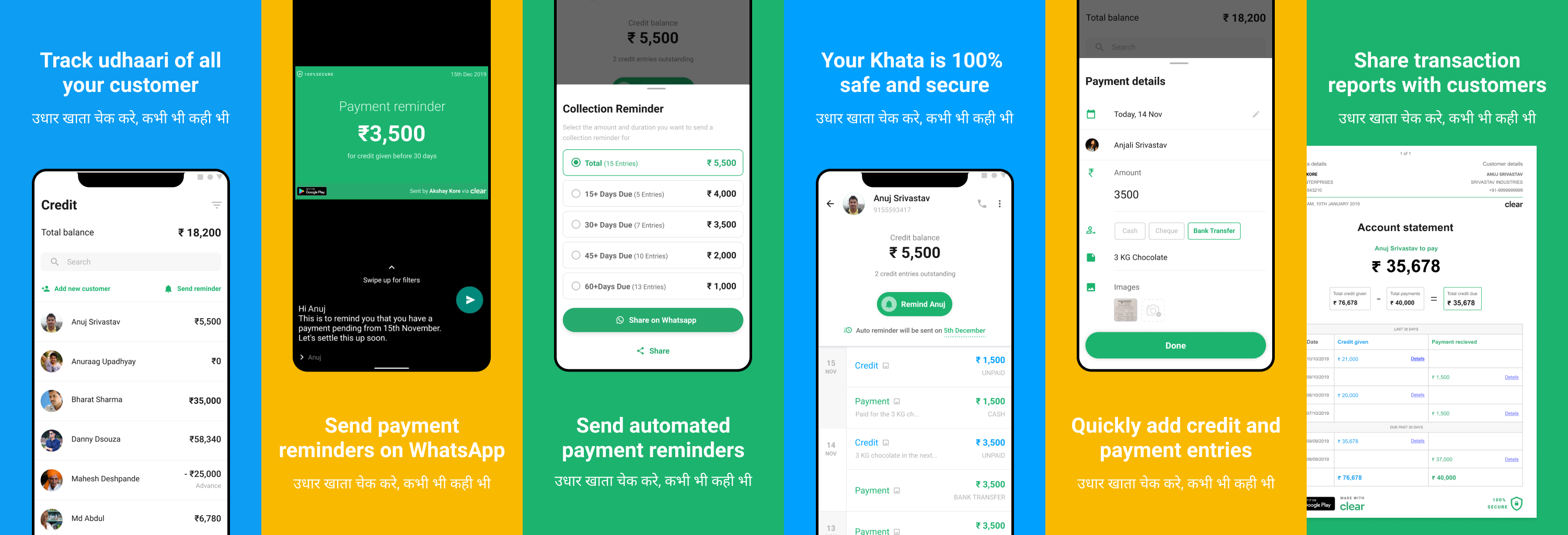

The Clear app enables Small and Medium (SME) businesses in India to keep track of credit given, send timely reminders and generate reports. In this project, I led the design for the app, user research, and built a design system.

Most SMEs in India, use a physical ledger to keep track of credit given. This physical ledger is also referred to as a bahi-khata. The Clear app does not aim to replace the ledger entirely since most SME owners are used to this mode and there would be greater friction for them to move from pen-and-paper to a digital medium. Instead, Clear augments their existing workflows by providing them tools to track and remind customers.

Current problems

- Inability to track credit in a timely fashion.

Most SMEs in India track all their credit in a physical ledger. This credit is often given for a specific time period (30, 60, or 90 days). Many business owners forget to keep track of these deadlines. - Awkwardness in asking for money

Asking for money is often awkward for SME owners involving a lot of back and forth with customers. Most SMEs avoid asking for money if they are smaller amounts. Over time this adds up to losses. - There is no single place to track all credit

Most SMEs keep yearly ledgers. If asked for a history of credit over longer time spans (2- 10 years) with particular customers, it is often difficult, cumbersome, and time-consuming for them to present this data. Many SMEs ignore this data which has the potential to generate insights about valuable customers. - Most SME owners are not tech-savvy

Although a large number of digital applications exist for SMEs to manage credit, many SME businesses choose to use physical ledgers due to their familiarity, trust in physical artifacts, and a lack of technical knowledge.

Design

The Clear app does not aim to replace the physical ledger entirely, instead, it augments their existing workflows by providing them tools to track credit, remind their customers, and generate reports in an intuitive and familiar way.

Design principles

I compiled a set of design guidelines to be followed for future features and products as follows:

- Universal

Our messages are clear and are communicated through simple, useful, and intuitive interfaces. Used around the world by a wide global community. Our products and visual language should be welcoming and accessible. - Local/Global

We need to speak to everyone but we recognize the individual. Our message is scalable and localizable. Design your user interface so that it can be localized for other geographies without redesigning the interface. - Friendly and Human

- Be credible and trustworthy

- Be helpful

Our user interface elements and copy should help our users accomplish their tasks with the least amount of friction. Being appropriate rather than consistent is more valuable. - Familiar

Use appropriate and smart defaults. The service should feel familiar to the user. We strive for elements that are easily recognizable and don’t require the user to jog her memory. - Limit distractions

It’s a myth that people can multitask. Short of chewing gum while walking, people can’t actually do two things simultaneously; they end up giving less attention to both tasks and the quality of the interaction suffers. Design for tasks to be carried out consecutively instead of concurrently in order to keep people in the moment. Make sure the user is performing one primary action at a time.

Key components

- An ability to create a digital ledger

The app allows users to add credit and payment entries easily to build a ledger. - Reminders

Asking for money is awkward. The app allows users to send self-initiated and automatic payment reminders periodically through their most preferred communication channels. - Reporting

The app allows users to generate reports for any time range easily in their preferred format. Additionally it also automatically sends daily and weekly reports and provides insights on customers’ payment status.

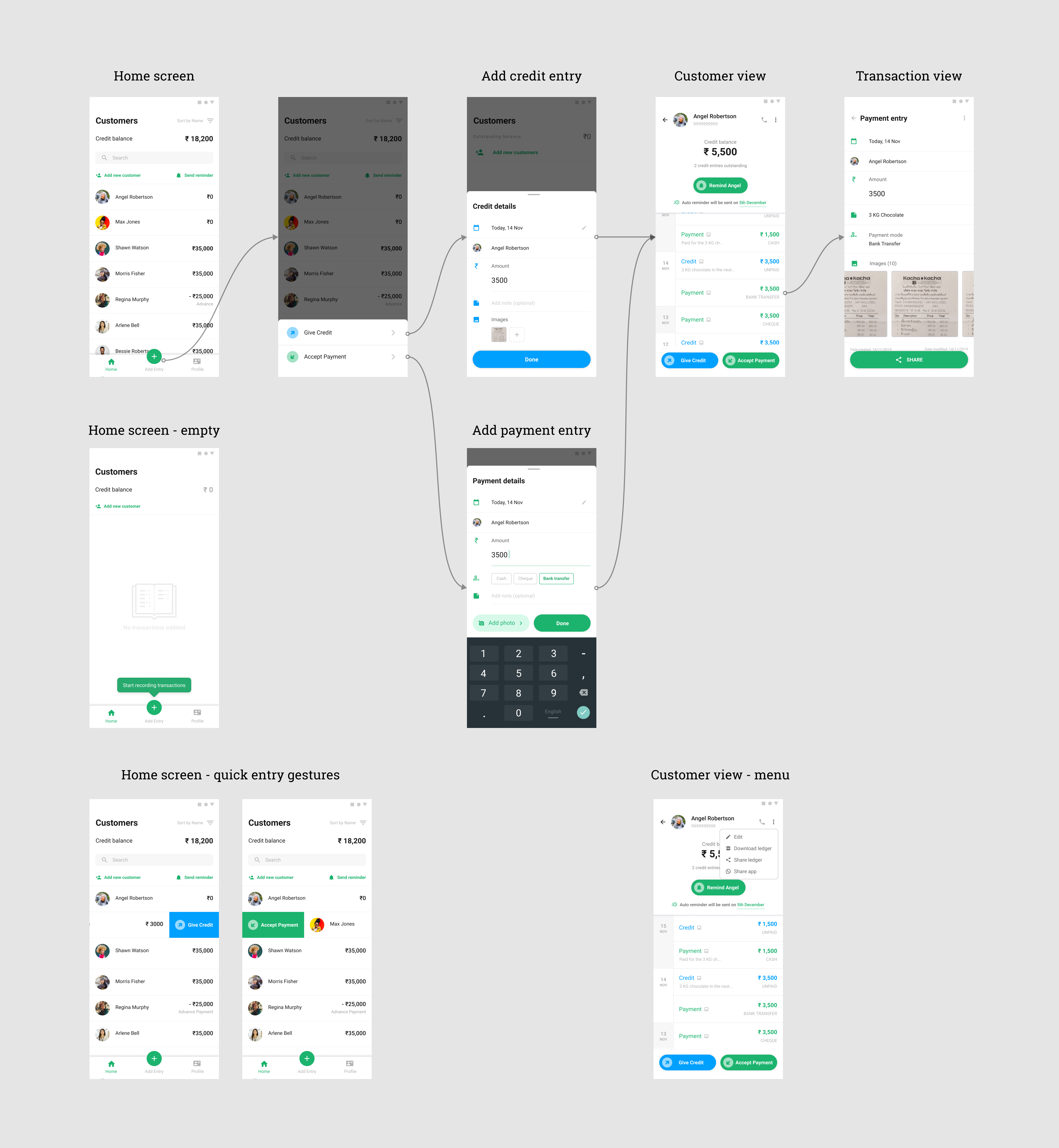

Creating a ledger entry

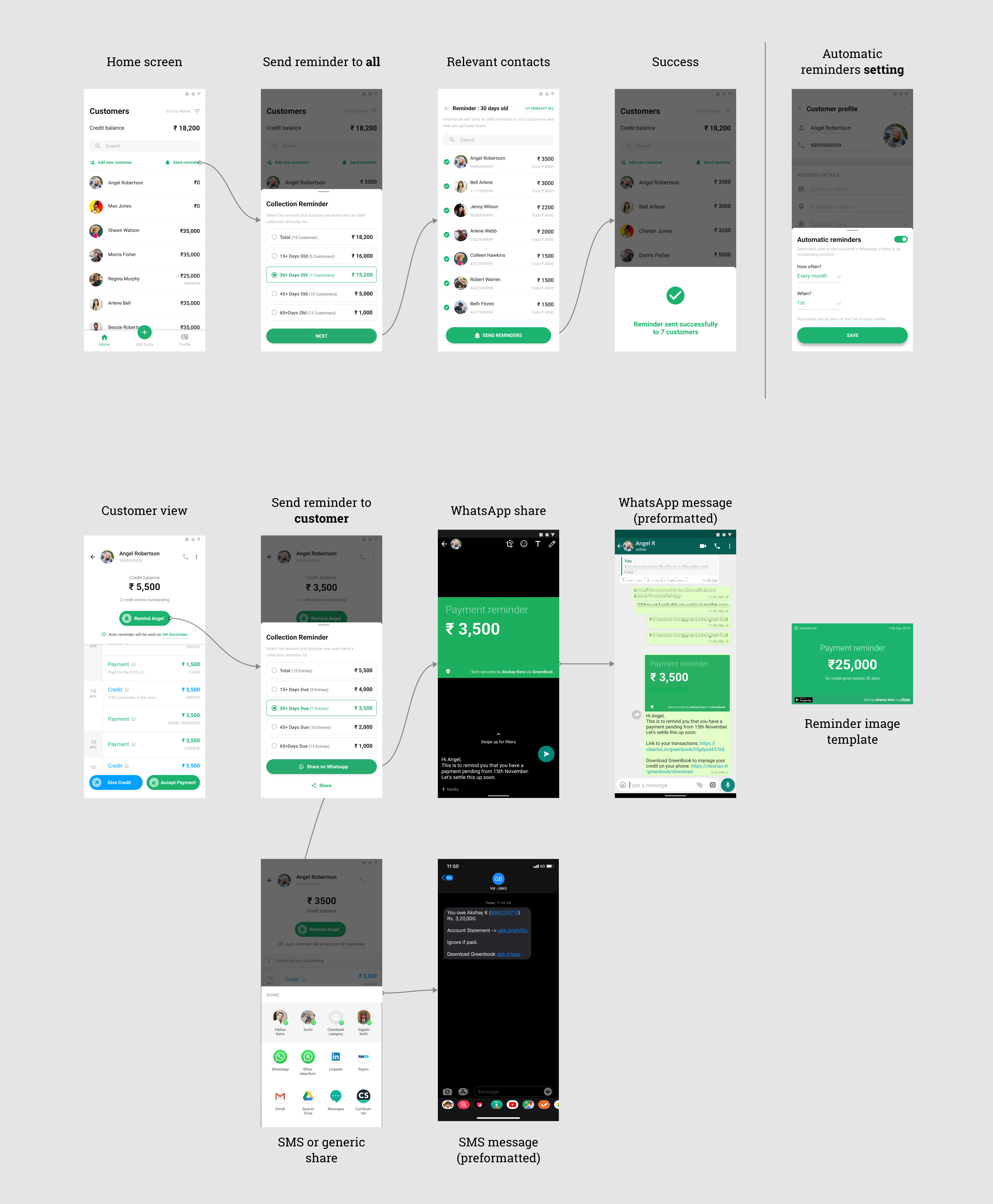

Reminders

Asking for money is awkward. The app allows users to send self-initiated and automatic payment reminders periodically through different communication channels:

- Customers can ask Clear to send reminders.

- They can choose to send reminders via Whatsapp

- They can choose to send reminders via SMS or other generic media.

Reports

The app allows users to generate reports for any time range easily in their preferred format. Additionally it also automatically sends daily and weekly reports and provides insights on customers’ payment status.

Onboarding and login

The goal of the onboarding was to let users log in quickly and easily. The team made a deliberate choice of using only a phone number-based login for the user group.

Search

Other

I also started working on future-looking scenarios for the ledger like invoicing and an advanced sharing mechanism.

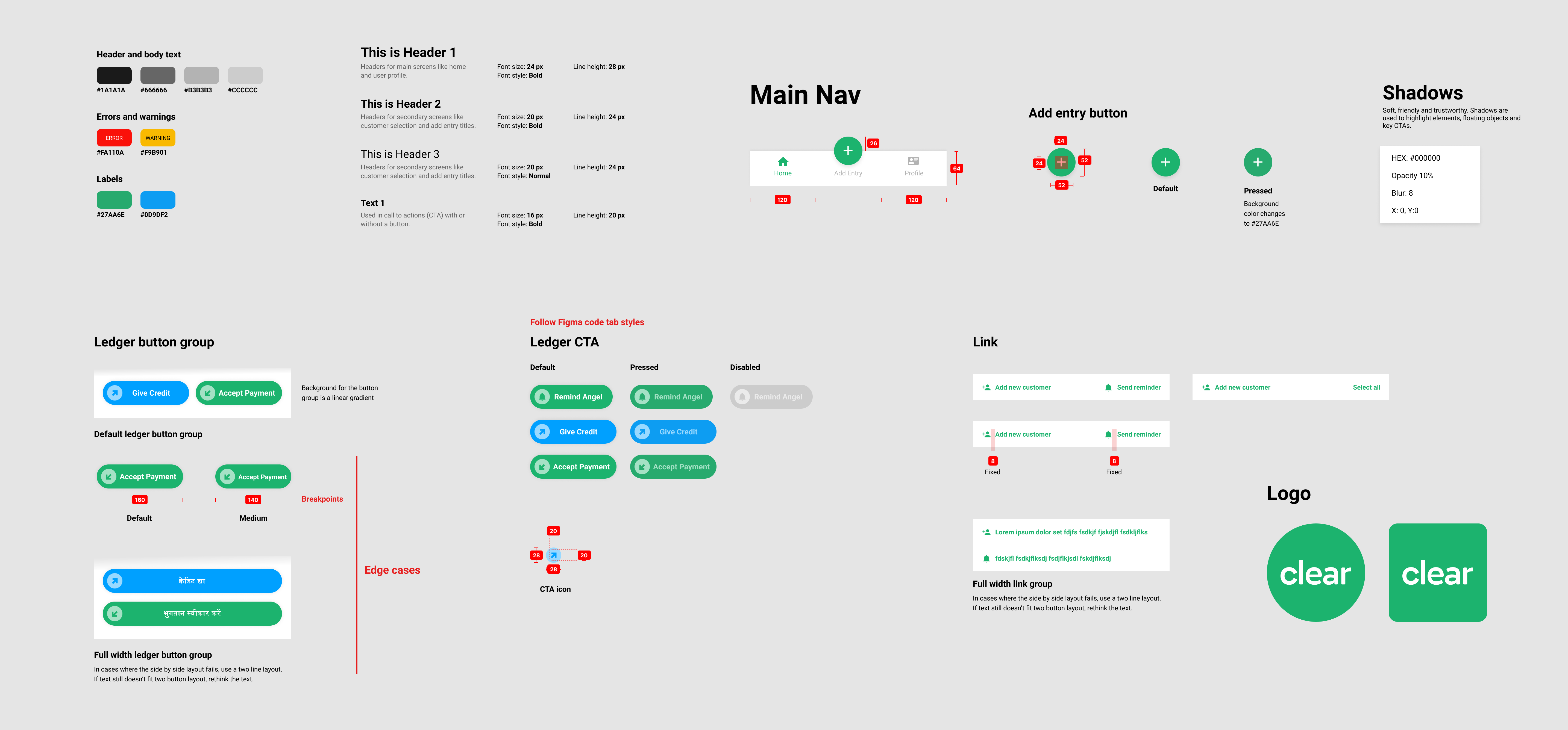

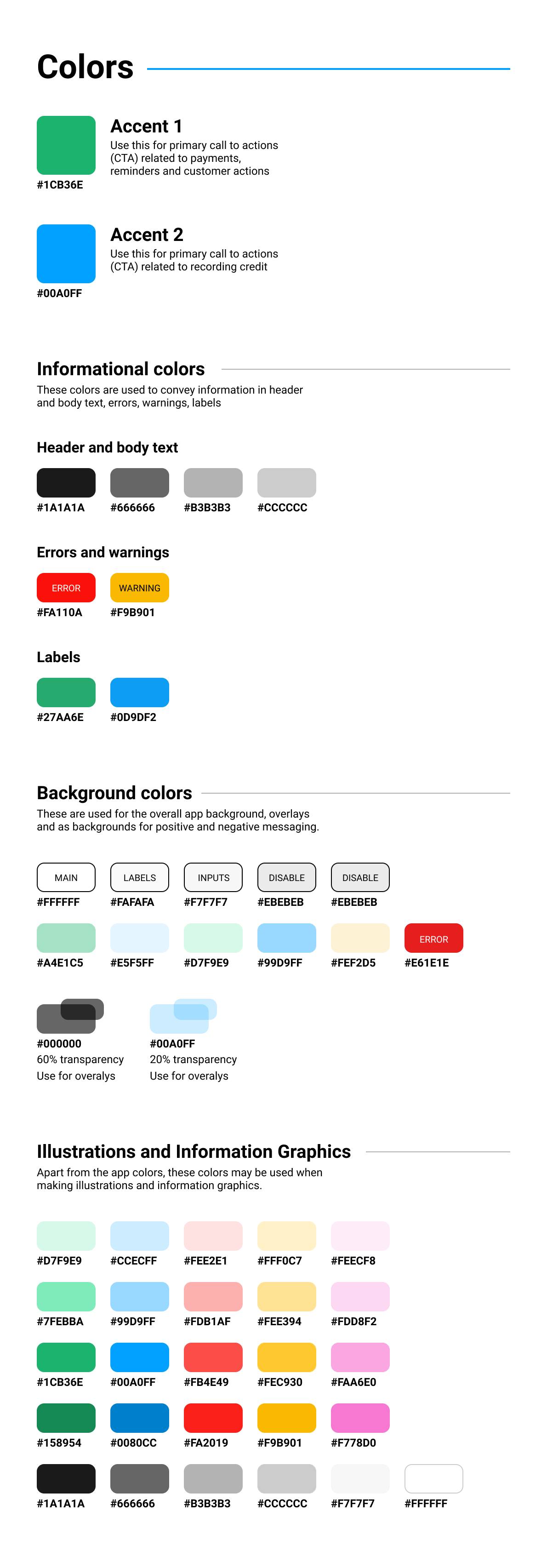

Design system

Creating components helps the product and development team in streamlining decisions. I built the style guide and a component framework for the app from scratch. This framework allows non-design team members to iterate and build smaller app features without a dependency on the design team.

Components

Typography

Colors

https://cleartax.in/s/clear-app

P.S. I worked on this app in 2019 and left Cleartax at the beginning of 2020. The app might have gone through changes after my departure.